Beyond the stadium: Tracking shifts in sports, consumers, and opportunities

- Rohit Tak

- Nov 6, 2025

- 7 min read

Updated: Nov 17, 2025

Not too long ago, mentioning sports in India typically meant talking about cricket. However, by 2025, the landscape has transformed significantly. What was once a largely untapped market has evolved into a vibrant, multi-billion-dollar sports ecosystem. This includes a wide range of activities, from cause-driven initiatives like awareness marathons to professional leagues and events, along with fitness influencers and government-supported programs. Overall, the sports scene in India has gained substantial momentum.

A combination of growing factors, including digital access, rising disposable incomes, government initiatives, and an increased focus on health and wellness, has driven the industry's growth. Whether you're a brand, investor, or simply interested in future trends, there is much to explore. Let’s begin.

Market overview

India’s sports ecosystem is undergoing a seismic shift, and the numbers are speaking loudly and clearly. By 2030, India’s sports market is expected to hit a whopping $130 billion, growing at a 14% CAGR. That’s nearly twice the country’s GDP growth rate. We’re not just discussing growth; this is a complete transformation in how 1.4 billion people engage with sports, entertainment, and lifestyle.

But here’s the kicker. This isn’t just about sports brands or athletic gear any more. The ripple effect is drawing in players from across sectors, including tech, tourism, athleisure, fitness, and nutrition.

Currently, we are witnessing the rise of a “sports-adjacent economy”, an interconnected network where industries not traditionally associated with sports are now riding the wave of this boom.

India isn’t just becoming a bigger sports market. It’s becoming a more psychographically rich one with a broader consumer base and creating a space for brands that understand the emotional, social, and aspirational layers tied to sport and movement.

Consumer profile

With over 65% of India’s population under the age of 35, the country boasts one of the youngest consumer bases globally. India’s sports consumer base is youthful, urban, aspirational, and digitally progressive. Moreover, with increasing disposable incomes, especially in smaller cities, we are witnessing new areas of sports enthusiasm emerge, while metropolitan cities continue to see a steady growth in the mass affluent category.

This shift in behaviour didn’t happen overnight. A major catalyst was the pandemic, which prompted a wider societal move towards wellness. From home workouts to playing a sport or going to the gym, physical activity has become part of daily life rather than just a recreational activity. Fitness and health have evolved from niche interests into widely shared values, especially among India’s urban youth. What’s even more interesting is how this mindset influences other lifestyle choices. This behaviour creates a domino effect. For example, a consumer who follows running influencers on Instagram might not only purchase shoes but also buy protein supplements, subscribe to fitness apps, and upgrade their athleisure wardrobe. This makes them more informed and selective, leading to stronger brand engagement.

But what’s driving this billion-dollar market? Let’s surf through the key drivers/factors that are playing a vital role in India’s sports market boom.

Tailwinds

1. Digital Penetration

India is now home to over 800 million active internet users, making it the second-largest online market globally. OTT platforms like JioHotstar, SonyLIV and Fancode have made sports content more accessible than ever. Rising fandom for F1, with motorsport viewership growing by nearly 30% over the past five years, and increasing interest in football leagues such as UCL, La Liga, and Premier League, showcases how digital penetration is diversifying India’s sports viewership.

Brands now have an opportunity to leverage OTT’s data-driven targeting and build niche engagement strategies, tapping digitally native, globally aligned fan bases shaping India’s sports economy.

2. Government Investment & Policy Push

Government interventions and ambitious state initiatives back the momentum behind India’s sporting rise. The Khelo India programme, with its sizeable annual funding, is strengthening grassroots participation, infrastructure development, and ensuring a wider talent pipeline. Similarly, the National Sports Policy 2025 signals intent at the highest level, positioning sport as a driver of both national pride and economic opportunity.

From Odisha’s hockey investments to the BCCI Centre of Excellence and Ahmedabad’s Olympic-ready infrastructure, these initiatives mirror institutional intent and efforts to establish sport as a driver of economic growth, promoting infrastructure, employment, and economic development.

3. Cultural Shift Toward Health and Fitness

Beyond gyms, formats like Hyrox, a global, mass-participation indoor fitness race, highlight how people are embracing sports and competitive activities as social, motivating experiences. This shift reflects a consumer mindset, where fitness is increasingly viewed as a holistic pursuit, blending personal achievement with social connection and serving as a marker of lifestyle identity. 4. The IPL Effect: From Cricket to Commerce

The Indian Premier League (IPL) transformed the approach to sports commercialisation. Originally just a tournament, it has evolved into a complex ecosystem influencing culture everywhere, from street corners to living rooms.

For brands, it has become the most valuable advertising stage. At the same time, for the economy, the league creates an economic halo effect spurring spikes in travel bookings, restaurant footfalls, and local business revenues through event tourism.

Its franchise-led, privatised model paved the way for other sports leagues to emerge. The Pro Kabaddi League, Indian Super League, Ultimate KhoKho, etc., follow similar models. This approach maintains ongoing fan engagement throughout the year and creates various revenue opportunities for private investors and brands.

Furthermore, franchises have developed into comprehensive entertainment and lifestyle brands, integrating sport with fashion, merchandising, and community involvement. These innovations have transformed franchises from seasonal teams into year-round businesses where private investment, fan culture, and brand collaborations come together, fostering not only sports revenue but ongoing economic activity across retail, technology, and entertainment.

Cross-Sector Analysis and Opportunities

1. Streaming and Subscription-Based Sports Content

Subscription platforms transform passive viewers into engaged participants by using gamification, community features, and personalised content. Here, content is not simply consumed but co-created.

For brands, this means more than just gaining viewers- it involves integration. The key opportunity is to embed themselves within these immersive experiences, connect with fans' passions, and reach a growing, tech-savvy audience that prefers active participation over passive watching.

2. Retail apparel and tech accessories

As India’s sports culture evolves, tech is becoming the new gym buddy. With the fitness tech market having touched $2 billion in 2024, smartwatches, fitness bands, and apparel are now staples for fitness-first consumers.

3. Amateur leagues and community sports

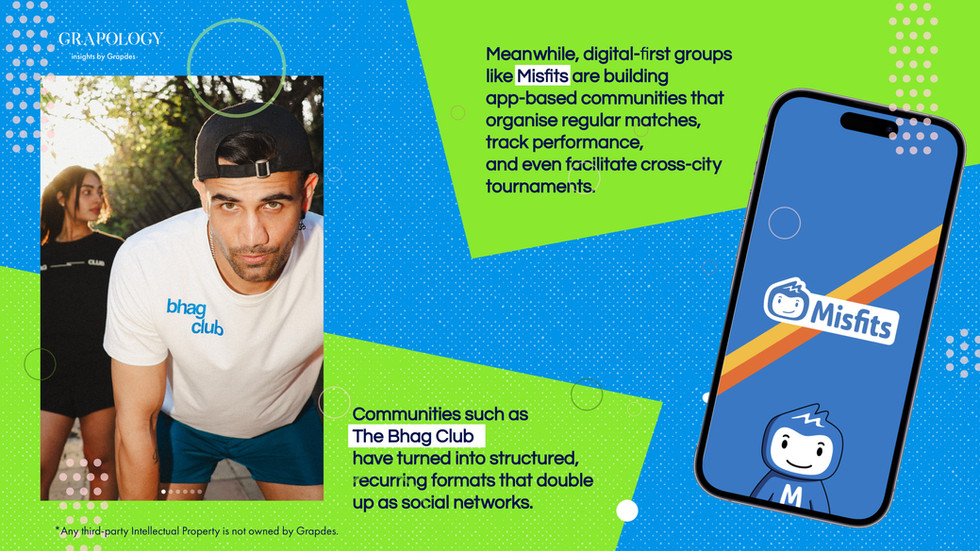

Community-level sports are thriving, from weekend football leagues to interoffice cricket matches. Platforms like Playo, BookforSport and Huddle are seeing this play out in real time with surging bookings and hyper-local demand.

Interest is increasingly expanding into new formats, with pickleball and padel gaining popularity as the next wave of urban sports. Tennis is experiencing renewed demand, and golf sessions attract younger professionals who see them as opportunities for both leisure and networking. What’s exciting is that this layer of sport is personal, social, habit-forming, and highly engaging.

This is an abundant ground for authentic engagement, where providing gear, subsidising facilities, or curating experiences can create trust and long-term loyalty.

4. Sports tourism and experiential marketing

The rise of sports tourism in India is telling. Events like the Mumbai Marathon and Ironman Goa are already attracting global participants, turning cities into sporting hubs. Meanwhile, platforms such as DreamSetGo are professionalising the sector, offering premium travel experiences for major events like Wimbledon, Formula 1, and Manchester City fixtures, where world-class hospitality combines with exclusive sports access. Collectively, these developments are positioning India not just as a sports destination but also as a burgeoning sports consumer economy with international importance.

Source: Future Market Insights 5. Health and nutrition

India’s nutrition and supplements market is booming, growing at a CAGR of 8.1%, while protein is moving from niche to everyday diets. Consumers are exploring supplements, protein powder, and protein-rich snacks/drinks, driven by health consciousness, lifestyle aspirations, and easier D2C access. For brands, the opportunity is to drive growth through product innovation while building a cohesive omnichannel presence that reinforces their identity and positions nutrition as an aspirational, everyday choice rather than a transactional product.

While the opportunities are massive, the Indian sports market also presents certain challenges that brands need to navigate carefully.

Regional Variations: India's diversity results in significant variations in sports preferences across different regions. What works in Mumbai might not resonate in Chennai, and a campaign that succeeds in Delhi might fail in Kolkata. Brands need to develop region-specific strategies while maintaining overall brand consistency.

Authenticity Concerns: Indian consumers today are more informed and harder to impress. Whether it’s wearables, experiential service, wellness, or nutrition, they’re quick to spot exaggerated claims or forced brand tie-ins. In a market full of choices, what truly stands out is authenticity.

Seasonal Concentration: Many sporting events, such as premier tournaments and marquee events in India, are concentrated in specific seasons, creating intense competition for consumer attention and increased costs. Brands need to balance sports marketing investments across the year to maintain consistent engagement.

With the government’s recent ban on real-money online gaming and fantasy sports apps, on the surface, it feels like one wheel of the sports economy has been badly injured.

But the wheel hasn’t stopped turning. Regulation has slowed one avenue of monetisation. However, as infrastructure improves, digital access expands, and fitness culture becomes a part of everyday life, consumers will become more informed, selective, and aspirational. They will actively seek high-performance, tech-enabled, and personalised products, pointing to a market that’s set to become more thoughtful, responsive, and sophisticated in how it engages, serves, and retains its desired audience.

Given the above challenges and many other hardships that brands might face, it’s clear that simply showing up isn’t enough anymore. That’s why we at Grapdes have developed a practical, impact-led manual/action guide designed to help brands not just react, but move with purpose.

Brands and businesses need to pivot their playbook. The rewards are immense for brands willing to listen, adapt, and play the long game. The vehicle is still very much in motion and taking a sharper, more deliberate path towards the future.

The question isn't whether brands should engage with India's sports market – it's how quickly they can develop the right strategies to capitalise on this unprecedented opportunity.

The game has already begun, a few red cards raised, but it’s far from full-time. The early movers are already scoring.